Congratulations! It is so exciting that you are getting ready to purchase a home. Being a homeowner can bring a level of security and freedom that renting doesn't provide—but to get there, you need to have a level of financial security so lenders will fund your loan. That financial security is shown to lenders via your credit score—which means you might need some credit help!

There are many different types of mortgages out there, and they come with different requirements—so before you worry about your credit, let's look at some standard numbers.

First-Time Homeowner: FHA

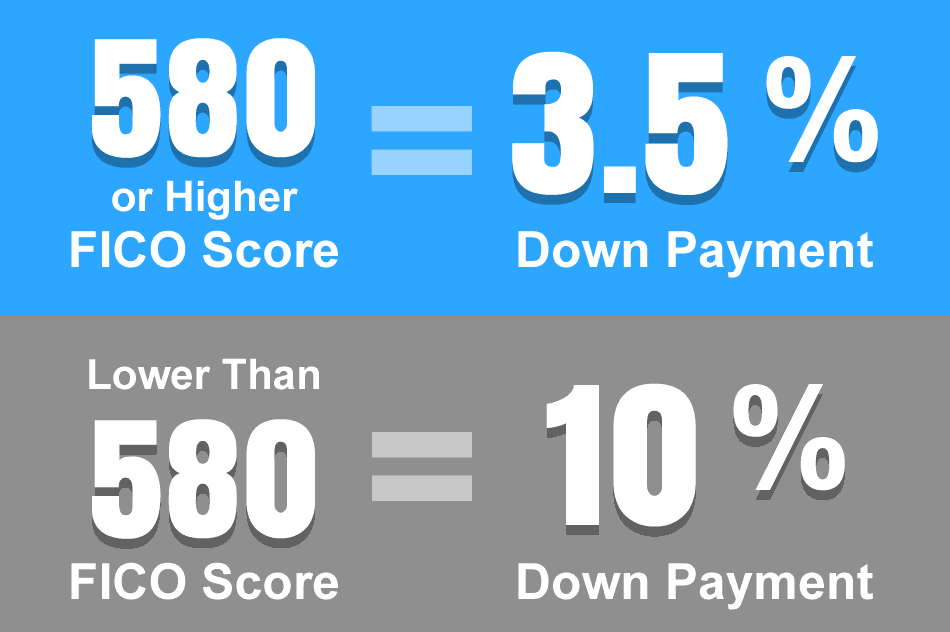

First-time homeowners can apply for an FHA mortgage, and the credit requirements for these loans are surprisingly low. A score of just 580 will qualify a buyer for a mortgage if they can put down 3.5%.

Less than 580, though, and you'll need a bigger down payment. However, this doesn't mean you're barred from buying a home!

- FHA home loans are still provided through private lenders; the government just backs them.

- This provides the lender with an added security layer, so they are generally still willing to lend to someone who has a lower credit score than a conventional lender will.

As a reminder, an FHA loan carries a form of Private Mortgage Insurance (PMI) for the life of the loan, so you'll want to weigh your options.

However, just because the government backs FHA home loans doesn't mean you can get one with a credit score that low. Given that a private lender still provides your loan—and right now, lenders are warier than they normally are about lending—you may still need credit help if you want to purchase a home.

Conventional Mortgages

A conventional mortgage is not backed by the government, meaning your credit needs to be higher to secure lenders' trust.

- A conventional loan will require you to have a credit score of at least 620.

- This also comes with the need for a significant down payment to back the loan.

- This down payment is generally around 20% of the purchase price of the property.

What if you don't want to pay the permanent PMI and don't have 20% to put down? Enter excellent credit: Sometimes, you can get a conventional mortgage with less than 20% down if you have excellent credit. More importantly, excellent credit can help you have lower interest rates on your mortgage.

Mortgage Interest Rates and Credit

So, it turns out you can generally get a mortgage with a 660 credit score. However, waiting until you have a higher credit score can save you some serious money during the life of the loan! How much? Well, the difference between a 4% and 5% interest rate on a $250,000 loan over 30 years is a whopping $27,000!

That is the cost of a car added to your loan—a nice car. It is also an increase in your monthly payment—and nobody likes that!

So, What Credit Score Should I Have to Buy a House?

You don't have to have an amazing credit score to buy a house—but the higher your credit score, the more you will save over the life of your loan. Current interest rates are very low, and it is a great time to buy a house if your credit can support it. However, if your credit is poor, and you can wait, it would be better to seek credit help to have a lower down payment and a lower monthly interest rate.

If you need help with Dallas credit repair, give us a call! A $99 Diva Discovery Session will let you know what we can do to help, and give you some actionable steps you can start taking right now! If you choose to become a Credit Diva client, that $99 rolls right into your package, so you don't pay twice.

The sooner you get started, the faster you'll be on the path to great credit!