Autumn breezes have cooled the fires of summer, leaves begin to turn, even in Texas. Folks turn their minds to the coming holiday rush. However, there’s another thing to think about: now is the time to start considering your financial plans for the new year.

If you’re thinking of buying a house or starting a business, this is essential. What you do during the holidays will affect your credit score heavily for the new year and beyond. Credit repair services will tell you:

- Don’t go crazy spending. Keep an eye on your spending/debt as a percentage of your total available credit. If holiday spending puts you over 30% of your available credit, it will seriously affect your credit score, and you may not be able to move forward with your house or business loan plans.

- Late payments on holiday borrowing will also severely impact your credit score.

- New credit accounts (tradelines), or even multiple applications for credit, will lower your credit score so only use new credit if you’re trying to establish or repair credit. Keep this in mind and think twice when the clerk asks if you want to apply for an additional ten percent by applying for their store card. Even if you’re making a big holiday purchase the amount saved is not worthwhile if you’re going to need a good credit score.

On the other hand, if you’re trying to establish credit, borrowing on a credit card or bank line of credit can help you out. As always, it’s important to use less than 30% of your available credit, but borrowing and making timely payments will improve your credit score.

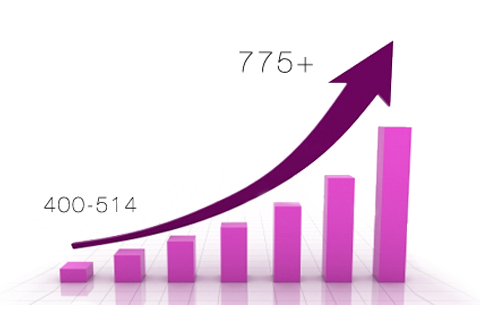

If you’re already in the credit doghouse, getting credit for a business or home loan is going to require time and money and some effort on your part. Credit repair services can provide expert guidance and offer services that can have an almost immediate impact to raise your credit score. Here are some basics:

- Pay high-interest cards down first. Put every extra nickel into one, then when it’s paid off, move what you were paying on that card onto the next.

- Pay more than the minimum payment.

- Pay your monthly obligations on time every month. Late payments will affect your credit score severely.

- Utilize the services of credit repair services. They will cover the basics, keep you on task, and can even offer advanced services like negotiating reduced settlement amounts with creditors.

Do you need help finding a credit repair company that fits your needs? Download our free Guide to Finding the Best Dallas Credit Repair Company for a helpful checklist you can use to compare credit repair options.